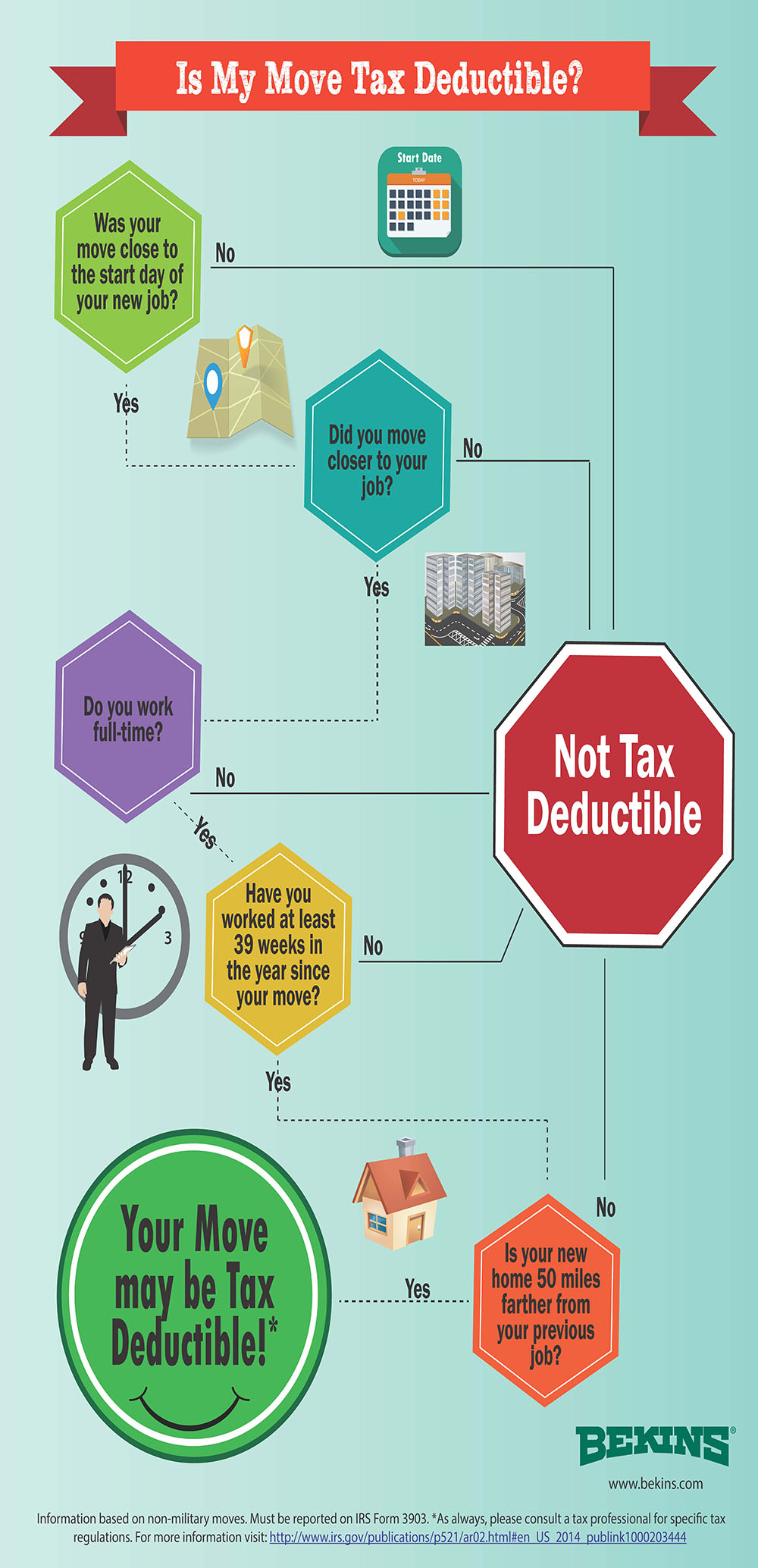

The three requirements are as follows:

- Time & Distance

- The move must be close to the start day of your new job

- Your new home must be closer to your job than your previous home

- Distance

- Your new home must be 50 miles farther from your previous job location

- Time Test

- If you are a full time employee you must have worked at least 39 weeks during the first 12 months after you have arrived at your new home.

For example:

Kourtney and her husband are moving because she was recently transferred from Downtown Cincinnati to the Glendale office in California. Currently, Kourtney travels 10 miles one way to her office. According to the IRS in order to qualify for the moving expense tax deduction, she will need to move closer to her new office and her new home must be 50 miles farther from her previous office.

Kourtney was transferred from Cincinnati on December 31, 2012 and she started her new job on January 15, 2013. As of February 2014 Kourtney completed the minimum requirement of 39 weeks of employment during her first 12 months in her new home. In April 2014 she filed form 3903 when completing her taxes. She was in fact eligible for the tax deduction and was able to write off much of her moving expense.

Working with Bekins proved much easier than determining her eligibility for the moving expense tax deduction associated with her long distance move. Her move was managed by a Bekins professional coordinator who assisted with planning, packing, loading options, and delivery.

On the day of her move, the local Bekins agent arrived promptly at 8:00am with extra moving boxes in hand. The friendly movers assisted with last minute details and immediately started loading. Kourtney was concerned with the possible damage to carpet and hardwood floors, however the moving professionals laid runners and special padding to protect the home’s condition. As items and boxes were being loaded, the driver of the Bekins Truck took inventory of everything including its’ physical condition. Kourtney signed the Bill of Lading (shipping contract) which confirmed the level of service requested and delivery date and time.

On the day of her move, the local Bekins agent arrived promptly at 8:00am with extra moving boxes in hand. The friendly movers assisted with last minute details and immediately started loading. Kourtney was concerned with the possible damage to carpet and hardwood floors, however the moving professionals laid runners and special padding to protect the home’s condition. As items and boxes were being loaded, the driver of the Bekins Truck took inventory of everything including its’ physical condition. Kourtney signed the Bill of Lading (shipping contract) which confirmed the level of service requested and delivery date and time.

On January 10th, Kourtney met with the Bekins movers who transferred her belongings 2,173 miles. After Kourtney paid for her moving expenses, the movers began moving each item. Kourtney checked off each item and its’ condition off of the inventory list and started moving into her new home.

As you can see, through Kourtney’s experience, she met the qualifications for the moving tax deductions and had a stress-free experience by choosing Bekins for her long distance move.